Average percentage of taxes withheld from paycheck

How Your Connecticut Paycheck Works. There are seven federal tax brackets for the 2021 tax year.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

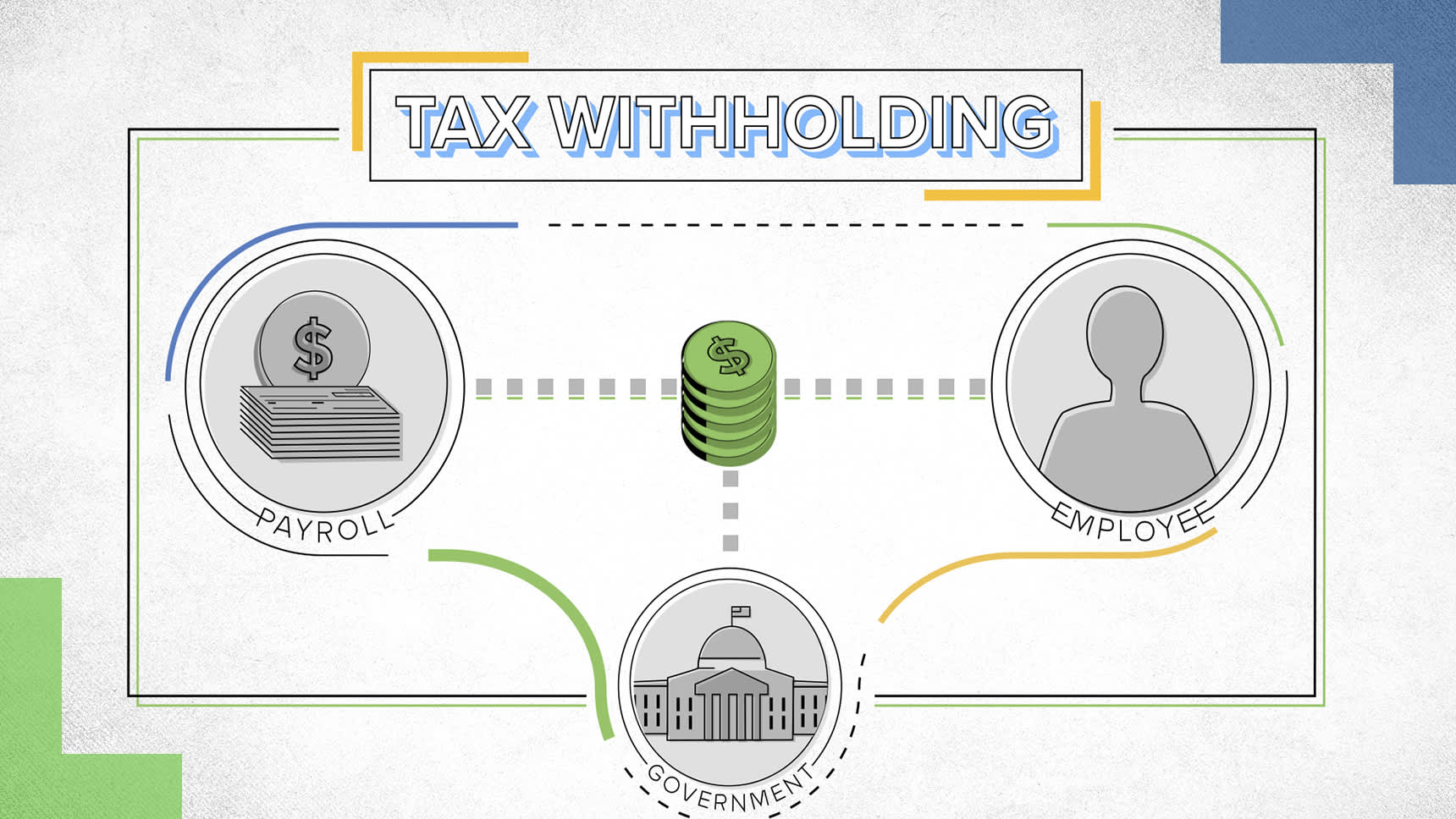

These amounts are paid by both employees and employers.

. See where that hard-earned money goes - Federal Income Tax Social Security and. Ad File State And Federal For Free With TurboTax Free Edition. This is wages per paycheck.

Your bracket depends on your taxable income and filing status. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. See where that hard-earned money goes - Federal Income Tax Social.

The IRS applies these taxes toward your annual. Missouri Paycheck Quick Facts. When you have a major life change.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The federal withholding tax has seven rates for 2021. For example if your pay is more than 209 but not more than 721 your employer will multiply your pay by 15 percent and add 1680 to the result to determine your tax withholding.

Only the very last 1475 you earned. Michigan collects a state income tax and in some cities there is a local income tax too. When to Check Your Withholding.

What is the percentage that is taken out of a paycheck. More Americans Trust Their Taxes To TurboTax Than All Other Online Providers Combined. For a single filer the first 9875 you earn is taxed at 10.

As with federal taxes your employer withholds money from each of your paychecks to put toward your. Discover Helpful Information And Resources On Taxes From AARP. Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly.

10 12 22 24 32 35 and 37. Your wages after allowances that exceed 1548 would be subject to a 25-percent tax plus a flat amount of 20105. New job or other paid work.

The wage bracket method and the percentage method. Overview of Alabama Taxes. Subtract line 5 from line 4.

You find that this amount of 2025 falls in. For 2022 employees will pay 62 in Social Security on the. Missouri income tax rate.

There are two main methods small businesses can use to calculate federal withholding tax. The Heart of Dixie has a progressive income tax rate in which the. Alabama has income taxes that range from 2 up to 5 slightly below the national average.

The amount of income tax your employer withholds from your regular pay. These are the rates for. How Your Paycheck Works.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Subtract 1548 from 222491 to arrive at 67691 which. You will be taxed 3 on any earnings between 3000.

FICA taxes consist of Social Security and Medicare taxes. Your 2021 Tax Bracket To See Whats Been Adjusted. Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Employers in the Nutmeg State withhold federal taxes from each of their employees paychecks. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Balance of withholding for the calendar year.

10 12 22 24 32 35 and 37. Elected State Percentage. Divide line 1 by line 2.

Check your tax withholding every year especially. Ad Compare Your 2022 Tax Bracket vs. For employees withholding is the amount of federal income tax withheld from your paycheck.

But calculating your weekly take-home. The federal withholding tax rate an employee owes depends on their income. Divide line 6 by line 7.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Do this later.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Is A Payroll Tax Payroll Taxes Payroll Tax Attorney

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2022 Federal Payroll Tax Rates Abacus Payroll

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

2022 Income Tax Withholding Tables Changes Examples

Government Revenue Taxes Are The Price We Pay For Government

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

Payroll Tax Vs Income Tax What S The Difference

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal State Payroll Tax Rates For Employers

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities